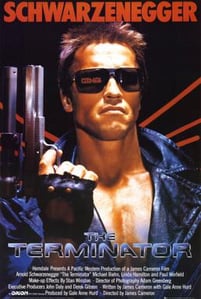

The time of the ‘Skynet’ prophecy and the robot takeover might be upon us… well chatbots for starters but don’t worry we won’t “need your clothes, your boots or your motorcycle”.

We’ll apologise in advance for the Terminator references as we explore artificial intelligence and in particular Bots or Chatbots in our Technology in Debt Collection blog series.

Chatbots have revolutionised communication between companies and their customers, ushering in a new era of engagement with a customer focus. Powered by artificial intelligence, web bots can understand complex requests, personalise responses, and improve interactions over time.

Simply put a bot is just a computer program that replicates a human conversation. People engage with the bot by typing or speaking, the programme then responds like a real person using phrases and words appropriate.

To sign-up to our monthly newsletter

Click Here

Chatbots are now at the forefront in driving the digital customer journey and experience, and as the technology becomes increasingly sophisticated we’ll see even more exciting developments in website interactions, account management in customer portals and product and services development.

Here are a few stats celebrating the influence of bots:

- 66% of Millennials versus 58% of Baby Boomers consider 24-hour service as the main reason for using chatbots.

- Chatbots are expected to generate over £6 billion in savings globally by 2022.

- This year (2020), it is expected 80% of enterprises will use chatbots or some type of AI automation.

- One of the top 5 industries profiting from Chatbots is Finance.

Here at CRS we’ve enjoyed incredible success using bots on our front line for our client’s customers. In this blog, we’ve uncovered the top 5 benefits for customers and why you should consider partnering with a DCA that uses artificial intelligence.

- Bot’s help self-service

- Their responses are automatic

- Chatbots are always on

- AI offers a smoother journey

- Plan B, get sent to a real person

So ‘Come with us if you want to live’…

Bots help self-service

Although many customers will want to discuss their needs with a collections agent if it’s detailed and complex, we’ve found for simple frontline queries, customers often enjoy interacting with chatbots.

Chatbots used on the frontline offer customers the feeling of independence as repetitive tasks can be executed easily without the need to interact with agents.

Their responses are automatic

In the fast-paced society we live in, digital customers now demand instant gratification. All requests are expected to be answered straight away and when the digital consumer has to wait it is known to create a level of discomfort and anxiety.

Chatbots offer a solution to this digital demand, as they are always listening, always working and providing they have the correct selection of responses within their programming the customer will receive an automatic response at the push of a button.

Want to know more? Here’s our Tech & Services brochure

Download Here

Chatbots are always on

Not everyone works a 9 to 5 workday. Life happens sometimes and often customers won’t get the chance to make contact within a collections department timeframe or may even completely forget.

Bots propose another option for customers struggling to fit into a company’s time frame by being accessible 24 hours of the day, 7 days of the week.

AI offers a smoother journey

Artificial Intelligence is created to evolve and ultimately it will replace humans as the programmes become more advanced. Replacing people might sound harsh but it’s not always a bad thing.

With a bot, the programmer can control the communication flow, moving customers in the desired direction and removing obstacles for them as the information is shared, creating an easier journey.

You also have the ability to control the tone of the bot to make sure it is a positive experience for the end-user allowing for a better and more enjoyable experience. This is especially important for vulnerable customers that suffer from anxiety with the thought of having to speak to another person about debt.

Plan B, get sent to a real person

Although chatbots are getting more and more advanced every day, not every question will be able to be answered directly by them (yet). So, with that in mind bots are a great tool to gather information before the customer is sent to an agent. This cuts away wasted time for both the customer and the agent allowing them to focus on the needs of the customer and finding a solution.

The CRS Way

Here at CRS, we have incorporated the spirit of innovation and development into the cultural fabric of our organisation and our dedicated in-house technology and design team are constantly looking to embrace new ideas to improve all of our systems and programmes including our AI.

Our customer portal chatbot or CRiS as we call him, allows 24/7 access to live interaction on our myCRS service.

We enjoy an 80% (and improving) success rate for answering customer chats and those queries just beyond the reach of its programming are directly forwarded onto one of our live agents, who will pick up the query and deal with it directly.

By answering the simple/common queries it allows agents to give time to the more ‘difficult’ queries.

If you’re interested in having a chat about our services

Click Here

…Oh and the real final words “Hasta la vista, baby” (again we’re sorry)